Data can be chaos in any industry, but none more than the renewables space. From operational efficiency and project finance to environmental metrics and local regulations, developers can have a hard time wading through the complexities to create business models that provide a path to mass production—and profitability. Tooraj Arvajeh, CEO and Cofounder of Perl Street, believes that software can cut through this noise to simplify asset management and unlock trillions of dollars in investor capital. By building a platform uniquely for the renewables industry, he’s helping distributed asset developers maximize their growth and efficiency. We sat down with Tooraj to learn more about how Perl Street is transforming renewable energy finance and asset management. Here’s what he said about Perl Street, the future of distributed assets, and the trajectory of the industry:

Simpler Reporting, Stronger Investments

Tooraj and the Perl Street Team are on a radical mission: to transform renewable energy and sustainable infrastructure into a financial asset. To do so, their platform takes complex project data and translates it into predictable financial info, solving the investment problems faced by many in the industry. A second-time founder with a background in fintech and mechanical engineering, Tooraj saw firsthand the reporting and management gaps that led to investment hurdles. Instead of clean energy, he watched a lot of equity go into software, but saw hesitancy to invest in renewables because of its complexity. He and the Perl Street team believed that by developing software for financial infrastructure, they could create an ecosystem where private equity could thrive. If teams could manage finances easier, scale better, and report reliably, they could attract the equity that would grow the industry and generate positive returns. The result was a distributed asset management platform, Perl Street, that makes investment easy for virtually anyone. He says, “The whole inspiration for creating Perl Street was to build solutions to unlock that capital. Let’s make climate tech and hardware assets cool, and let investors appreciate the values that these assets generate.”

“The whole inspiration for creating Perl Street was to build solutions to unlock that capital. Let’s make climate tech and hardware assets cool, and let investors appreciate the values that these assets generate.” – Tooraj Arvajeh

Defining and Standardizing a Financial Asset

Tooraj’s vision of renewables as a financial product is a simple, yet revolutionary, concept. If Perl Street makes renewable portfolios a predictable and reportable asset, they’ll be able to attract larger financial institutions and pension funds to invest. “Right now, the capital market recognizes real estate mortgages, credit cards, and car loans as a financial product that everybody essentially can invest in—and I think renewable energy needs to get there,” he says.

“Right now, the capital market recognizes real estate mortgages, credit cards, and car loans as a financial product that everybody essentially can invest in—and I think renewable energy needs to get there” – Tooraj Arvajeh

To see this transformation happen, Perl Street’s platform seeks to speed up the creation process of an essential building block: large developer portfolios. On their own, machines and projects are too variable to become predictable assets. The ups and downs of financing, generation, and operation don’t offer the type of stability that investors seek when providing equity. “When you have a portfolio of projects that are performing,” he says, “you have reliable financial information that you can actually create financial products out of.” For Tooraj, the central piece of the financial asset puzzle is standardization. If Perl Street can help developers create a universal definition for an investable asset, or close to it, investors can know what they’re purchasing and have a benchmark for revenue. But, there are countless complexities playing into this equation, like geography, loan structure, operational efficiency and more that they need to sort through first.

Better Infrastructure For Distributed Energy

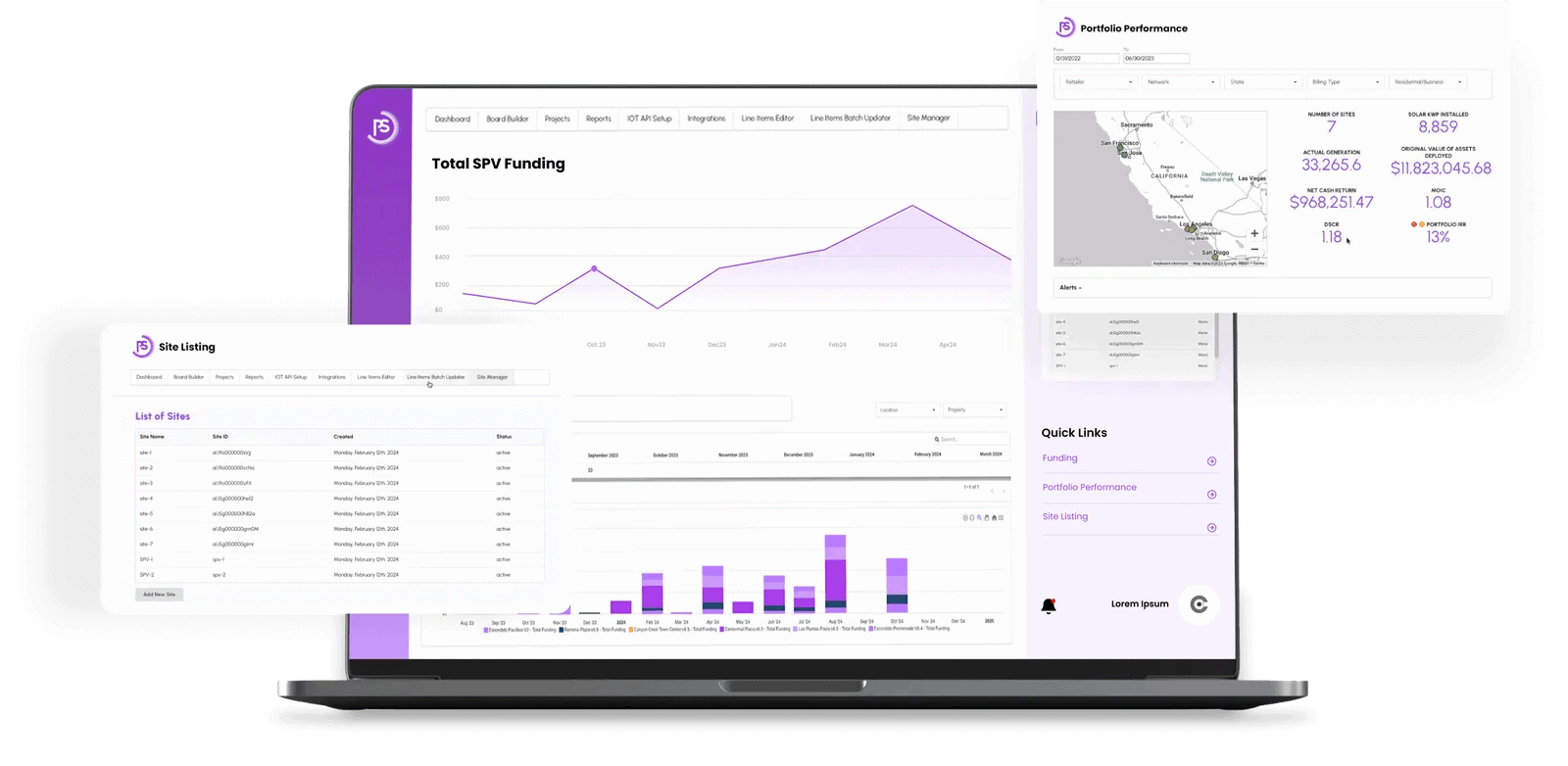

To bring about this change, Tooraj and team designed Perl Street to cut through the chaos of data so developers can create a scalable business model that works. Tooraj says, “we’re looking at these cashflows from different markets. How do you put them together in a portfolio for investors? How do you develop those underwriting criteria so that the risks are minimized? I think that’s going to be a Holy Grail for bringing a lot more capital into this space.” Their solution was purpose-built cloud infrastructure for renewable energy finance teams. The platform takes the existing benefits of legacy Excel management like flexibility and data management power, but adds the scalability, security, and compliance elements needed for success in the renewables industry. Plus, it wraps it in a UX-friendly, low-code package. Because of the platform’s uniqueness and power, Tooraj’s team can onboard developers using either a top-down or bottom-up approach. For teams with a ready tech background, it’s as simple as giving the users the software, letting them discover the value for themselves, and championing the change internally. These developers often have a CTO and see the most immediate value. Other times, Tooraj and team take the more direct path of working with developers on their growth goals and showcasing how the platform can help them meet targets. They discuss long-term strategy and illustrate how IT needs to be a part of their vision. “This a lot of times brings the Aha moment to management teams,” Tooraj says. “If you want to get to 10 gW of assets by this date, there’s no way unless the proper technology is in place.” No matter the approach, Perl Street naturally creates changes in organizational culture by making developers more data driven. They push teams out of the messy exploration phase of scaling and create standardized, integrated paths forward. He says, “if the business model is already growth oriented, has aggressive targets, and is looking like a mass production, those become crucial ingredients.”

Navigating the Future of Renewable Energy Finance

Leading the team at Perl Street, Tooraj is situated at the crossroads of big data and renewables. This gives him unique insight into the trends shaping the industry’s future. A hot topic in many sectors, he sees AI having a big impact on the clean energy market from beginning to end. The software could help with contract development to do most of the work before experts get involved. It could also optimize portfolios, serving as a copilot for forecasting analysts. He and the Perl Street team are also working closely with the non-profit Rocky Mountain Institute on solving some of the emerging challenges facing distributed resources. They’re a part of a group called the Virtual Power Plant Partnership, finding answers to tough questions surrounding communication and protocols. “We contribute to the evolution of the virtual power plant policies that make DR assets part of a much larger, great infrastructure—and that’s very valuable,” he says. Tooraj also sees the potential for explosive growth in virtual power plants and distributed resources. Because of the boom in AI data centers and EV charging, the demand and price for grid energy will increase. Much of grid cost is in transmission, so consumers will need distributed “behind the meter” assets in close proximity to drive costs down. He says, “I see that the future of energy is going to be more and more distributed.”

Building The End-to-End Financial Pipes with Perl Street

Setting ambitious goals, Tooraj and team seek to make Perl Street the de facto platform for renewable energy financial management and project finance. With broad adoption, the industry will be able to eliminate friction and market fragmentation across the value chain and achieve auto-industry levels of financial efficiency. This puts them in place to build the necessary financial infrastructure to mobilize enough capital to help the US meet its aggressive net-zero targets.

“We have been building these critical financial infrastructures like straight financial pipes—putting them together from both ends and joining them in the center.

First, we built tools to speed up the project development process to reach bankability. Good quality projects can mobilize capital—not the other way around. It’s not a chicken and egg problem. After working with 50+ companies and unlocking $300m+ in asset financing, we started offering financial management technologies to reduce the complexity of renewable energy assets for capital providers.

These pipes enable capital providers to originate and manage projects easily, and developers can use embedded financing solutions to increase sales.

As a mechanical engineer, when using energy modeling software tools like Autodesk, EnergyPlus, Ansys, or HelioScope, I always wondered why there was no financing button for qualified opportunities and making simulations into real deployments. Now, that dream is coming true!”

They also have their sights set on improving developers’ ability to report ESG metrics with new features on their product roadmap. The sustainability benefits are great, but guidelines like GRESB make reporting about dollar signs as well. “There is a direct linkage between the deployments of these assets, which basically is driven by dollar signs, and the ESG reports. There are coefficients we can use, or all of these multipliers, to translate dollars to ESG metrics.”

“There is a direct linkage between the deployments of these assets, which basically is driven by dollar signs, and the ESG reports. There are coefficients we can use, or all of these multipliers, to translate dollars to ESG metrics.” – Tooraj Arvajeh

Ultimately, Tooraj hopes that Perl Street can create a fundamental change in the way the industry thinks about project creation. With the platform simplifying their processes and data, developers will have the power to integrate their construction, finance, and asset management into their business model. This collapses their value chain and enables them to unlock the real value of their portfolio. As a result, forward-thinking developers can simplify their approach and create large, distributed networks of projects, like King Energy. By marrying technology and project development, Perl Street hopes to influence the DNA of the industry to move towards simplicity and standardization. Tooraj notes, “I think that’s the biggest issue that I’ve seen in the whole space of energy: a lot of folks just make it more complicated.”