There’s something comforting about the permanent-yet-impermanent quality of a multi-tenant commercial property. Hosting everything from bubble tea shops and chiropractors to franchise restaurants and dog groomers, these rotating carousels of businesses are a staple in cities, suburbs, and small towns across the country. And while the individual businesses may change, the buildings themselves remain, making them a perfect location for commercial solar projects.

Solar energy is nothing new, so why don’t we see solar panels on every multi-tenant commercial property?

A major part of the solar puzzle is financing. Installing solar isn’t cheap, and financing solar on multi-tenant properties is particularly challenging. In this article, we outline the three options currently available for financing solar on commercial properties and highlight the pros and cons of each:

1. Purchase or finance a solar system

One option is to take out a loan to finance your commercial solar project.

There are now many lenders offering loans specifically for solar projects, so it’s worth shopping around to get the best deal. But as a property owner, you already have good relationships with your bank and they can often simply extend your existing loan if the building has any equity in it.

The catch? This is an expensive option and no matter who provides financing they will want a lien on your property or some other form of credit support. This opens up a basic business question for all commercial building owners: If your bank is willing to lend you money to either build solar or buy another building, doesn’t it make more sense to stick to your core business and buy another building?

When you buy a solar system, you are entering a new business: the energy business. You become responsible for maintaining and operating the system, keeping up with changing ordinances and interconnection rules, regularly reevaluating your cost benefit given changing energy prices, and investigating new technologies like batteries and electric car chargers. This can be a headache, and frankly risky for a team that has built its business expertise on property ownership and building management not energy.

Finally, there is real complexity around allocating the solar energy to your tenants. Without technology in place to handle the allocation, it can be a messy and difficult process each month for multi-tenant properties.

The bottom line is that owning a solar system on any commercial property, regardless of how you pay for it, is usually the least appealing option.

2. Power purchase agreements

One option for financing commercial solar is to use what’s called a Power Purchase Agreement (PPA). A PPA is a long-term contract whereby you agree to buy all the power generated by the solar system from the solar developer that installed the system.

With a PPA, a third-party solar developer finances, installs, owns, operates, and maintains the solar system on your property. In turn, you agree to purchase all the electricity that it produces at a fixed rate for a set period of time regardless of whether you need the energy or not.

This can be a great option for businesses that consume the entirety of a property’s energy, but it isn’t compatible with multi-tenant properties. A PPA is tied to one business entity and the energy can’t be easily shared across tenants. Additionally PPA’s generally require a long-term commitment of 20 years and an escalator whereby the price you pay for the solar energy goes up each year.

Most importantly, when you sign up for a PPA you are buying something not selling something. The money is flowing from you to the developer in exchange for a reduced cost of day time energy. This can goose your NOI with a lower cost of energy, but a PPA won’t increase your rent roll and it won’t increase your cap rate.

Bottomline: PPA’s work best for large corporations who own the property and are the sole business in the building. They are difficult to pencil for multi-tenant property owners.

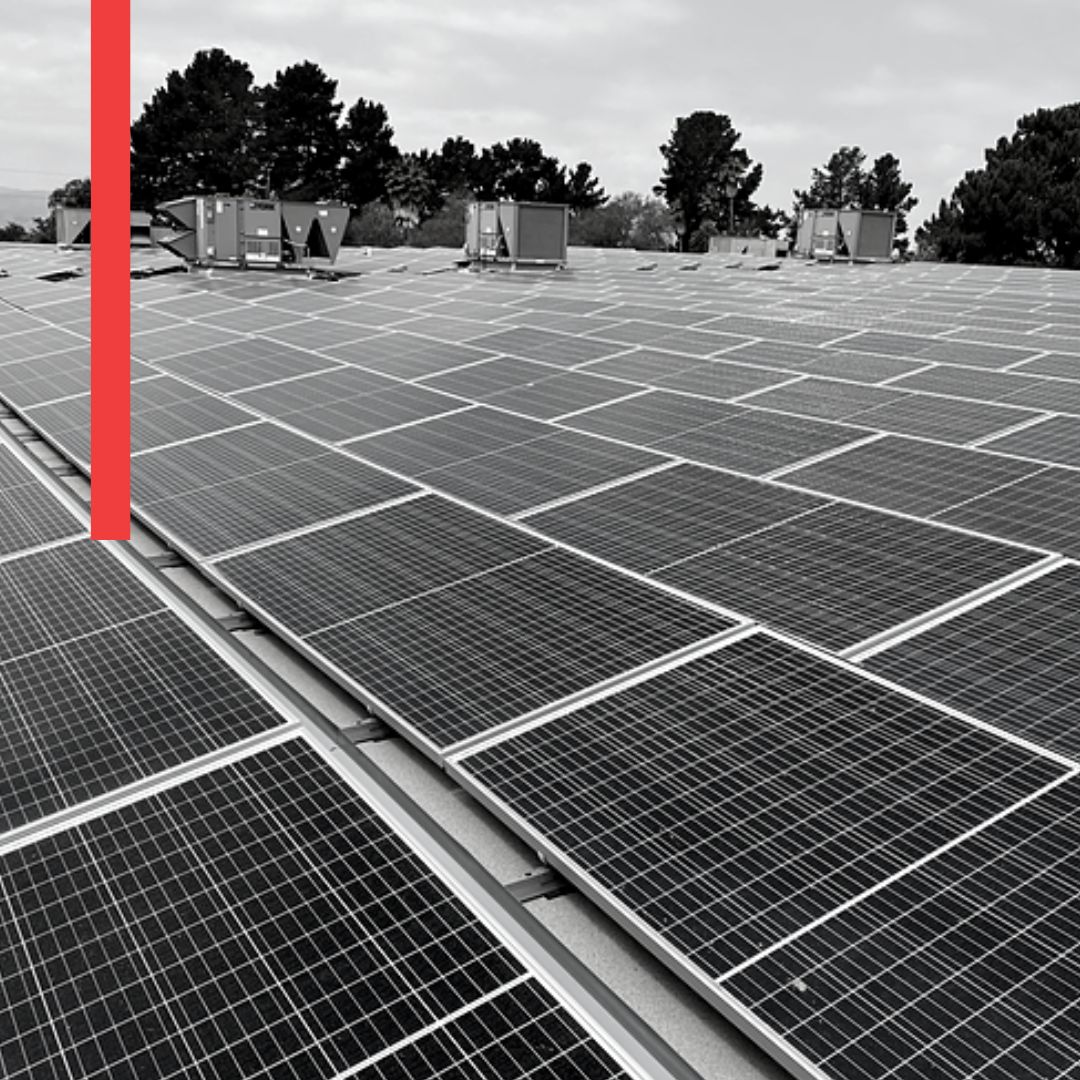

3. Just rent your roof: the King Energy model

King Energy created a successful new model specifically for multi-tenant commercial building owners. Here’s how it works:

- We pay you rent for your unused roof or your parking lot space. Unlike a PPA, the money flows from us to you. We pay for everything, we manage everything. You pay nothing. We are a tenant just like every other tenant in your building.

- Our rent is just like every other tenant’s rent. It qualifies as passive income, which is important if you’re a REIT, and is classified as true rent which is additive to your rent roll without any TI’s or capital investment on your behalf. This immediately boosts the cap rate and value of your building.

- In turn, optionally your tenants can buy our solar energy at a discount so they benefit from lower energy costs by being in your building, which is good for tenant retention.

The bottom line? You get a new source of long-term rent and tenants save money on energy, all with no cost or hassle.

How are we able to do this? King Energy developed a new way to finance commercial solar programs, aggregating the energy consumption across all of the individual tenants at a property. Then we use our leading edge software, King Energy OneBill™, to create a fantastic experience for your tenants who want low cost solar energy.

It’s incredibly convenient and easy for both you and your tenants.